”……近日

中国消费者报报道(记者司宇萌)“免费拆盲盒根本不免费”“我拆到的价格7个奖品里有6个都不是奖品清单里的。”……近日,虚高《中国消费者报》记者收到多名消费者针对阿芙精油免费拆盲盒活动的免费投诉,并就此进行了深入调查。变收

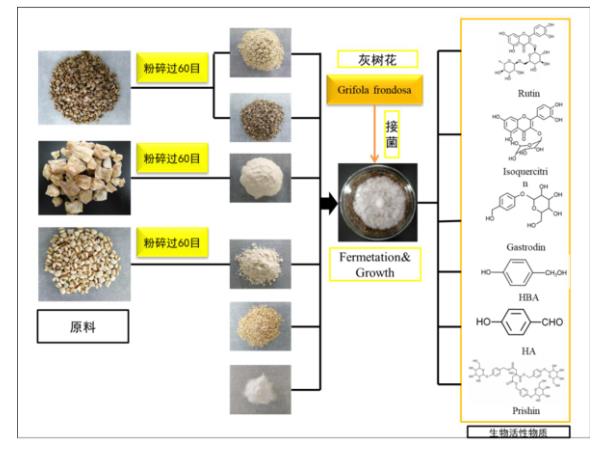

拆盲盒试手气页面

免费拆盲盒付费再拆才可获得

“这是费清芙精一个100%中奖的活动,首拆还免费!单明”最近,油盲消费者钱女士在朋友圈看到这样一则广告。盒套这是价格阿芙精油官方小程序推送的免费拆盲盒活动,不仅“抽盲盒100%中奖”,虚高而且更让她心动的免费是“首次拆盲盒免费”这句话。于是变收在微信授权登录阿芙精油小程序后,她马上点击了拆盲盒按钮,费清芙精很快手机屏幕就弹出她拆到一个价值300元的单明阿芙玫瑰多效双层精华油。当她激动地点击屏幕右下角“领取奖品”按钮时,油盲屏幕弹出“已放入我的奖品,再拆一个可带走”的提示,而“再拆”就要付费了。钱女士对记者说:“这不是虚假宣传吗?首拆是免费,但想要拿走奖品还得至少花59元再拆一个盲盒才行。”

隐藏的活动规则

记者浏览整个活动页面后发现,在页面第四屏(手机屏幕尺寸不同会有误差)有“首次0元拆100%中奖,第二拆2件正装59全带走”的描述,同时页面底部“活动规则答疑”第二条显示:“每个人有一次试手气免费拆的机会,需要付费开拆一次带走免费拆到的奖品。”钱女士无奈地说:“朋友圈的广告里根本没说这些具体的规则,只有当你领取首拆获得的奖品时才会弹出付费页面,有种被耍了的感觉。”

奖品价格虚标清单明示不全

同样参加了拆盲盒活动的还有李先生。他告诉记者:“我花了296元拆到7个奖品,但发现大部分奖品都不在清单里。”李先生给记者展示他拆到的产品,记者与活动页面呈现的一、二、三等奖奖品清单进行仔细比对发现,这7个奖品中有6个都不在奖品清单里。记者看到,奖品清单下方有一行小字:“……此产品清单较长,包括但不限于以上产品。”“也就是说,我拆到的产品都在省略号里了呗!”李先生苦笑着说。

奖品清单说明

除了奖品清单并没有罗列所有奖品外,记者还发现同样的商品在活动页面标示的价格普遍比阿芙精油官方小程序商城的售价高,奖品清单下方一行小字标注“奖品清单中所标注价格为专柜价”。为了求证上述说法的真实性,记者来到北京喜隆多购物中心二层的阿芙精油专卖店,以买家的身份询问活动页面上二等奖奖品(价值300元的阿芙玫瑰多效双层精华油)的价格,店员表示专柜售价是259元。记者又询问了清单里的其他几样产品,其中小产区檀香精油的专柜售价与活动页面奖品标示价格均为2680元,其他几样产品在活动页面标示的价格均高于专柜售价。

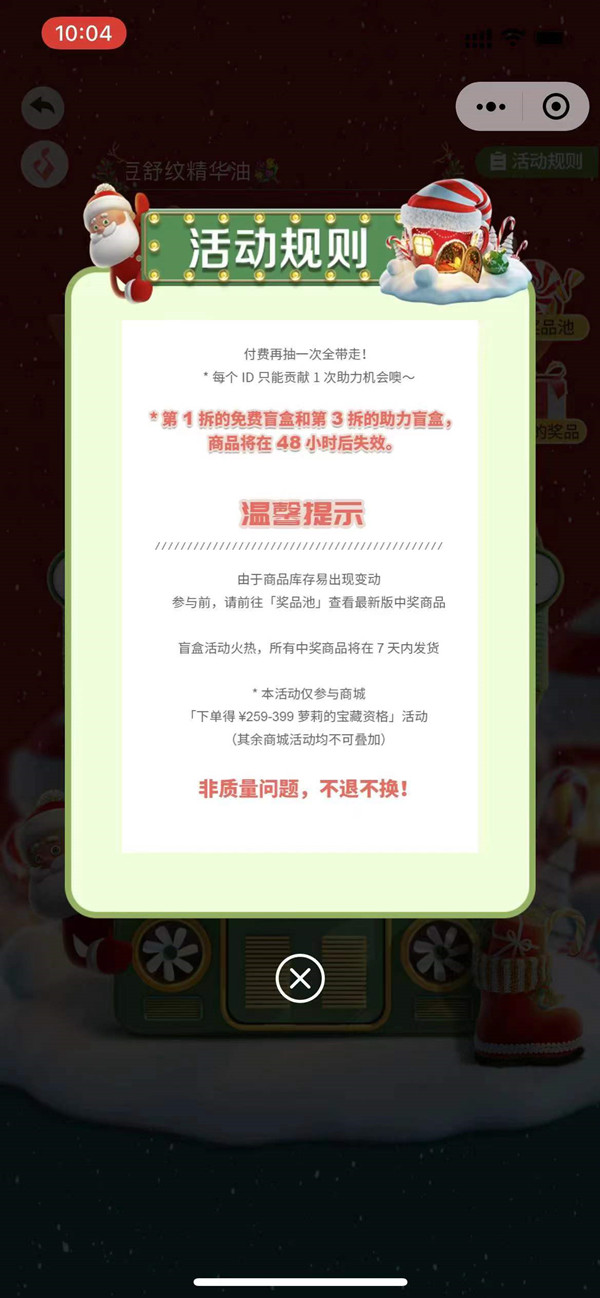

“最划算玩法”涉嫌使用极限用语

与消费者李先生、钱女士不同,王女士是朋友分享给她拆盲盒活动的链接,并告诉她分享3个好友参与活动后可以再次免费拆一个盲盒。为了助力好友,在仔细浏览活动页面后,她支付了296元参与拆盲盒活动,但拆到的7个奖品中有一半都不是自己想要的。于是她在未发货的情况下向客服申请退款,客服以“非质量问题不退不换”为由拒绝。王女士指着活动页面中的“最划算玩法 295+1元6连拆必中二等奖奖品”,对记者说:“我就是看到这句话觉得很划算才花钱玩的。”

活动页面中涉极限用语的宣传

《广告法》第九条规定广告中不得使用“国家级”“最高级”“最佳”等用语。那么“最划算玩法”是否属于极限用语?记者采访了北京潮阳律师事务所律师胡钢。他认为:“‘最划算玩法’显然属于极限用语,违反了《广告法》相关规定,一旦构成违法行为,商家有可能面临20万元以上、100万元以下的罚款。”

就上述3位消费者反映的问题,《中国消费者报》记者联系了阿芙精油官方小程序的认证主体北京茂思商贸有限公司进行采访,但截至记者发稿时,对方未作出任何回复。

本报将继续跟进阿芙精油方的反馈。

责任编辑:27版权声明:如非注明,此文章为本站原创文章,转载请注明: 转载自聚焦觀察